Today we’re featuring a guest post from MYRA, a firm that offers virtual financial planning, investment management, and tax preparation services for immigrants. Whether you’re starting out, entering mid-life, settling down, or nearing retirement, they’re here to help you through every phase of your personal finance journey!

If you’re an immigrant currently working in the United States, you may be wondering if you’re required to pay federal income taxes.

The answer is, immigrants do pay taxes, and they often have to deal with a host of unique problems like language barriers and filing taxes for the first time.

Individual federal income tax returns for the tax year 2022 are due on or before April 18, 2023.

To make the process a bit easier, we’ve created this comprehensive guide to filing taxes for immigrants.

Who Must File Taxes?

U.S. citizens aren’t the only ones who are required to pay taxes. Immigrants that are authorized to work in the United States must pay the same state and federal income taxes that citizens do.

The Internal Revenue Service (IRS) defines residency in a different way than U.S. immigration law. For tax purposes, workers are categorized as either resident or nonresident aliens.

RESIdent aliens

If you are not a U.S. citizen, the IRS considers you a resident alien, for tax purposes, if you pass one of the following tests:

- Green card test: U.S. Citizenship and Immigration Services (USCIS) gives you an alien registration card, or “green card” that allows you to reside in the United States as an immigrant permanently.

- Substantial presence test: You have been physically present in the United States for at least 31 days during the current year and 183 days during the three-year period that includes the current year and the two years prior.

The filing requirements for resident aliens are the same as those for United States citizens.

nonresident aliens

A nonresident alien is a noncitizen who “has not passed the green card test or the substantial presence test,” according to the IRS.

People who are not U.S. citizens and do not qualify for either of these tests are required to file a tax return if they own a business in the United States or they have a United States income that wasn’t taxed enough by their employer. Temporary visa holders may also want to consider filing an income tax return to receive a refund for tax withheld.

What is a W-4?

If you work in the United States, your employer will ask you to complete a W-4 form. W-4 forms determine what amount will be withheld in taxes from your income. This would be different from anything you earn from your H-1B passive income.

The W-4 form includes worksheets that help you figure out how many “allowances” to claim. Every allowance that you have reduces the amount taken out of your pay. You may have one allowance for yourself, one for a spouse, and one for every dependent that you claim.

How to Pay Taxes in the United States

Some countries allow the government to withhold taxes without any personal filing requirements. The process in the United States is trickier.

For instance, you may not know what tax obligations you’ll have as a result of investing in opportunity zones, freelancing, or holding foreign assets that you need to report.

Here is a list of all the things that you’ll need to file taxes:

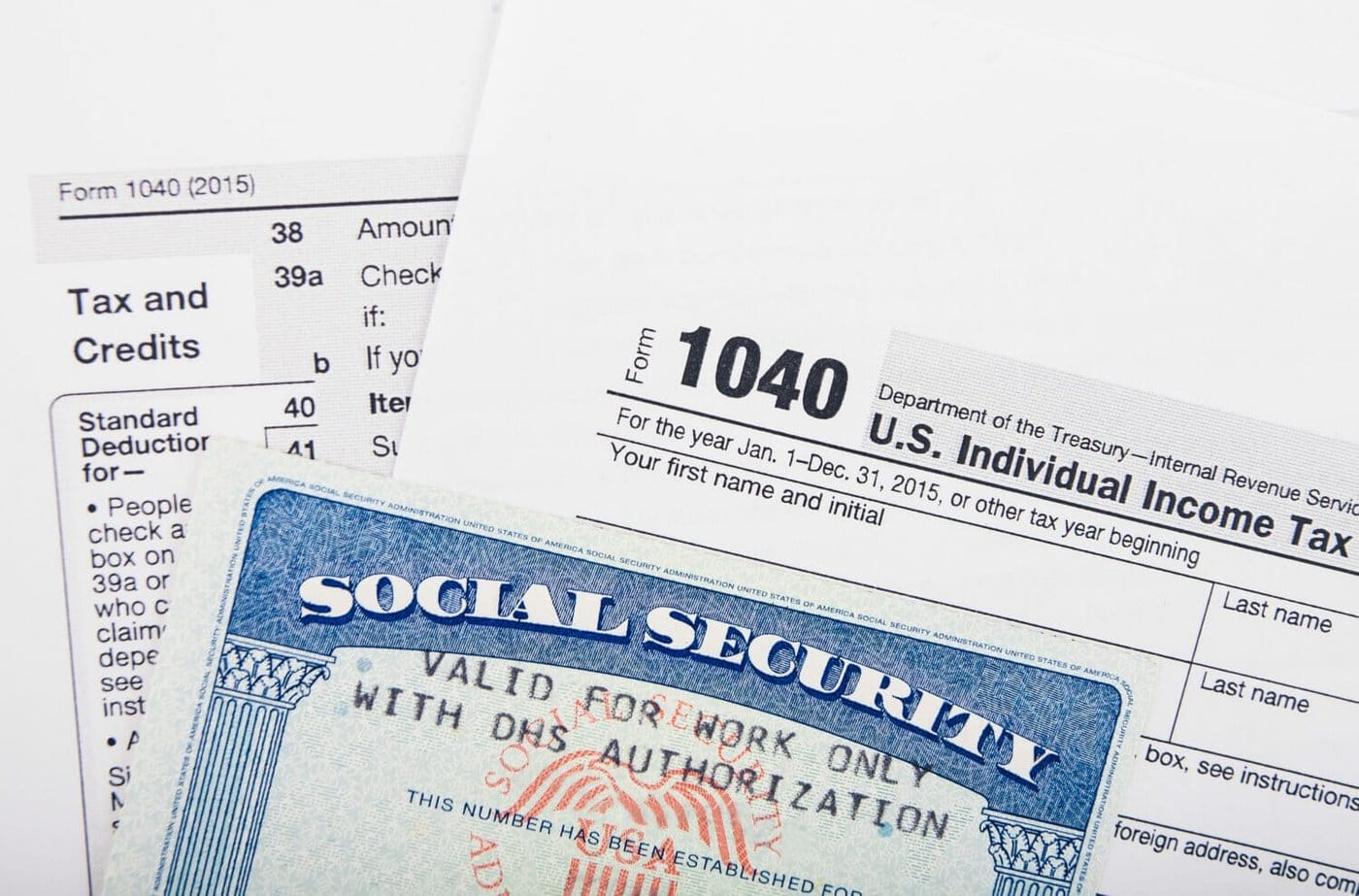

SSN or ITIN

You can only pay taxes in the United States if you have either a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). People who are authorized to work in the United States by the Department of Homeland Security are eligible to apply for a Social Security number before they arrive in the United States.

You can also visit a Social Security office and complete the “Application for a Social Security Card” (Form SS-5). You will need to provide documentation that proves your identity, work-authorized immigration status, and age.

If you aren’t eligible for a Social Security Number, you can apply for an individual taxpayer identification number by submitting Form W-7 (officially called the “Application for IRS Individual Taxpayer Identification Number”). You must submit this to the IRS along with documentation that proves your foreign status and identity.

Which Forms to File

The tax forms that you will use to file taxes depends on whether you are a green card holder or you are in the United States on a temporary visa.

Green card holders use Form 1040 (officially called the “U.S. Individual Income Tax Return”), the same form that U.S. citizens use. Form 1040 is typically due around April 15 each year. In 2023, the due date is April 18.

People on temporary visas file their tax return using Form 1040-NR (officially called the “U.S. Nonresident Alien Income Tax Return”). The deadline for filing this form is also April 18, 2023.

Reporting Income From Outside of the United States

Many people receive income from outside of the United States, even after they start working in the U.S. Green card holders have to report income from outside of the country on their tax return.

You may be able to exclude a portion of these earnings from your taxed income. To find out if you are eligible and the exclusion amount, use Form 2555 (officially called “Foreign Earned Income”).

Additionally, keep in mind that you’ll have to pay exit tax if you decide to leave the United States.

The Benefits of Paying Taxes

Filing a tax return and paying taxes in the United States does not mean that people on temporary visas and undocumented workers can receive Social Security benefits.

Nonetheless, there are still benefits to paying taxes:

- Shows that you comply with federal tax laws

- Proves “good moral character” for people who hope to apply for a green card or U.S. citizenship

- Documents presence and employment history in the United States

- Tax benefits (for instance, the Child Tax Credit)

- Insurance premium tax credits for children that are U.S. citizens

Get Help as an Immigrant Filing Taxes

The IRS has a Volunteer Income Tax Assistance (VITA) program that helps taxpayers who cannot afford tax preparation, need the help of a translator, or have questions about applying for an ITIN.

You can visit a VITA site by going to the IRS Free Tax Prep site and entering your ZIP code.

Before you visit the website, make sure to read through Publication 3676-B so you can learn more about the services that VITA offers. Also, check out what to bring with you so that you can collect all of the documents you’ll need to apply.

If you have any concerns, don’t hesitate to reach out to a qualified tax professional. They’ll be able to help you make sense of the process, make sure you are receiving all applicable deductions, and get you on the right path moving forward.