What Tax Documents Do I Need For a Marriage Green Card Application?

Learn about the tax requirements when applying for a marriage green card

The U.S. government wants to see evidence that the spouse seeking a marriage-based green card will be financially secure once in the United States, and isn’t likely to rely on public benefits in the future.

Boundless offers unlimited support from our team of immigration experts, so you can apply with confidence and focus on what’s important, your life in the U.S. Learn more.

Who Needs to Provide Tax Documents?

The sponsoring spouse needs to provide U.S. federal tax returns as part of Form I-864 (officially called the “Affidavit of Support”), a signed document to promise financial support of the spouse seeking a green card. If the sponsoring spouse and their household are unable to meet the minimum financial requirements of a family-based green card, then a joint sponsor will also need to include their tax returns. Learn more about the additional documents needed for joint filers here.

If the sponsoring spouse didn’t file taxes in the United States, they will need to provide an exemption letter. Learn more here.

The spouse seeking a green card does not need to include any tax information

Boundless helps you build a tailored visa plan for every step of the process, from forms to your immigration interview. Get started today!

Which Types of Tax Documents Do I Need to Include?

The types of tax documents needed depends on the form.

Financial Support Form (I-864)

The sponsoring spouse (and financial co-sponsor if any) will need to provide the following tax evidence as part of Form I-864:

| Document Type | Examples of Acceptable Documents | Who Needs It? |

| Proof of ability to financially support the spouse seeking a green card | A 1040, 1040-A, or 1040-EZ form and all supporting documents (including the W-2, 1099, or foreign income statements and schedules) ORA federal tax return transcript | Sponsoring spouse and financial co-sponsor (if any) |

U.S. Immigration can be complex and confusing. Boundless is here to help. Learn more about what Boundless can do to help.

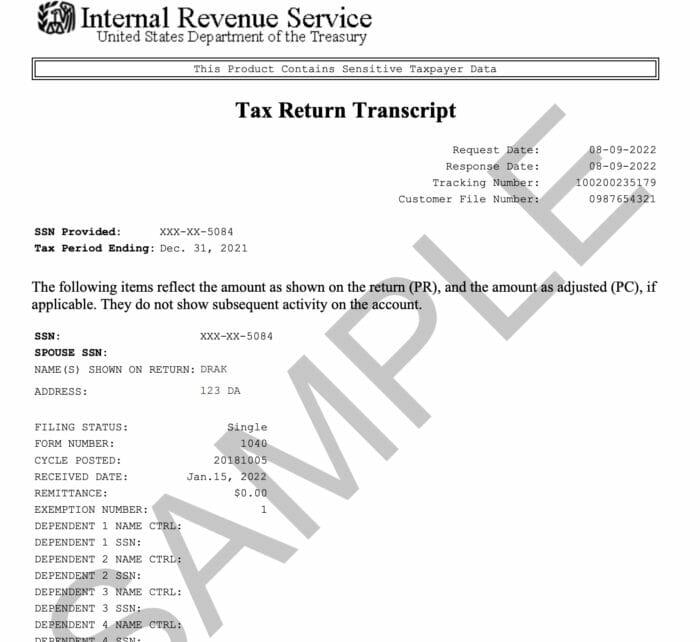

What Does a Tax Return Transcript Look Like?

A federal tax return transcript is a document that shows a summary of your tax return information. The sponsor can request their transcripts from the Internal Revenue Service (IRS) website for the most recent 3 years they filed taxes.

What should I do if I can’t access my Tax Return Transcript from the IRS website?

If you can’t access your tax return transcript for a particular filing year, you instead need to provide a signed affidavit (written statement) explaining why you’re unable to obtain the transcript and that you will continue to try to obtain it to bring to your green card interview. You’ll also need to provide a screenshot of the IRS website showing that your transcript is inaccessible through the IRS “Get Transcript” tool.

Boundless can help you avoid common pitfalls in the immigration process with unlimited support from our team of immigration experts. Learn more.

How Many Years of Tax Returns Are Required?

For Form I-864, the U.S government requires proof of tax filing for the most recent filing year (typically the previous calendar year). Note that the the sponsor (and co-sponsor if any) has the option to provide tax filings from the past 3 years.

Boundless has helped more than 100,000 people reach their immigration goals. We’ll be your visa planning partner from beginning to end. Get started today!

What If You Filed Joint Taxes?

If the couple filed joint taxes, they will need to provide their federal tax return transcript and all supporting documents (including the W-2, 1099, or foreign income statements and schedules). This requirement applies to Form I-864.

U.S. Immigration can be complex and confusing. Boundless is here to help. Learn more about what Boundless can do to help.

What If the Sponsor Didn’t File Taxes?

If the sponsoring spouse (or joint sponsor if applicable) didn’t file any taxes in the previous year, they will need to provide an exemption letter as part of Form I-864 explaining why they didn’t file taxes. The letter should explain that the sponsor’s income was below the minimum income required to file in the previous years or years, and therefore they did not file a federal tax return for those years.